Kā tirgoties ar binārajām opcijām Deriv

Kādas ir opcijas?

Opcijas ir produkti, kas ļauj gūt izmaksas, prognozējot tirgus svārstības, bez nepieciešamības iegādāties pamatā esošo aktīvu. Jums tikai jāatver pozīcija, kas paredz aktīva svārstības noteiktā laika periodā. Tas ļauj cilvēkiem piedalīties finanšu tirgos ar minimāliem kapitālieguldījumiem.

Deriv pieejamās opcijas

Deriv platformā var tirgoties ar šādām opcijām:

- Digitālās opcijas , kas ļauj paredzēt divu iespējamo iznākumu un nopelnīt fiksētu izmaksu, ja jūsu prognoze ir pareiza.

- Atskatīšanās , kas ļauj jums nopelnīt izmaksu atkarībā no optimālā augstākā vai zemākā līmeņa, ko tirgus sasniedzis līguma darbības laikā.

- Call/Put spredi , kas ļauj nopelnīt līdz noteiktajai izmaksai atkarībā no izejas vietas pozīcijas attiecībā pret diviem definētajiem barjeras līmeņiem.

Kāpēc tirgoties ar opcijām Deriv platformā?

Fiksēta, paredzama izmaksa

- Ziniet savu potenciālo peļņu vai zaudējumus vēl pirms līguma noslēgšanas.

Visi iecienītākie tirgi un vēl vairāk

- Tirgojieties visos populārajos tirgos, kā arī mūsu patentētajos sintētiskajos indeksos, kas pieejami visu diennakti.

Tūlītēja piekļuve

- Atveriet kontu un sāciet tirdzniecību dažu minūšu laikā.

Lietotājam draudzīgas platformas ar jaudīgiem diagrammu logrīkiem

- Tirgojieties drošās, intuitīvās un viegli lietojamās platformās ar jaudīgu diagrammu tehnoloģiju.

Elastīgi tirdzniecības veidi ar minimālām kapitāla prasībām

- Lai sāktu tirdzniecību un pielāgotu savus darījumus savai stratēģijai, veiciet iemaksu tikai no 5 USD.

Kā darbojas opciju līgumi

Definējiet savu pozīciju- Izvēlieties tirgu, darījuma veidu, ilgumu un norādiet likmes summu.

Saņemt cenu piedāvājumu

- Saņemiet izmaksas piedāvājumu vai likmes summu, pamatojoties uz jūsu definēto pozīciju.

Iegādājieties savu līgumu

- Iegādājieties līgumu, ja esat apmierināts ar cenu piedāvājumu, vai arī no jauna definējiet savu nostāju.

Kā iegādāties savu pirmo opciju līgumu vietnē DTrader

Definējiet savu pozīciju

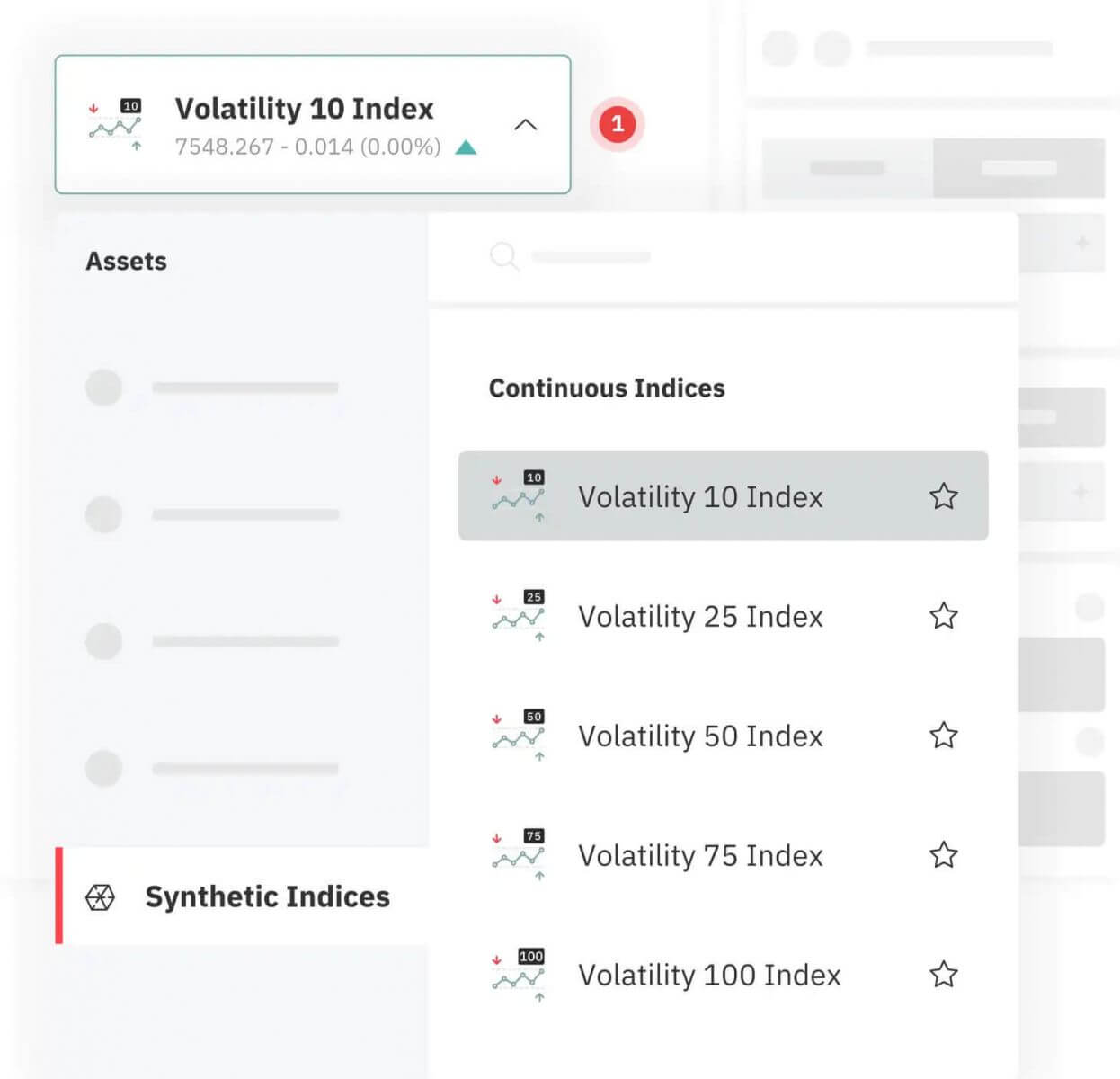

1. Tirgus

- Izvēlieties vienu no četriem Deriv piedāvātajiem tirgiem – forex, akciju indeksi, preces, sintētiskie indeksi.

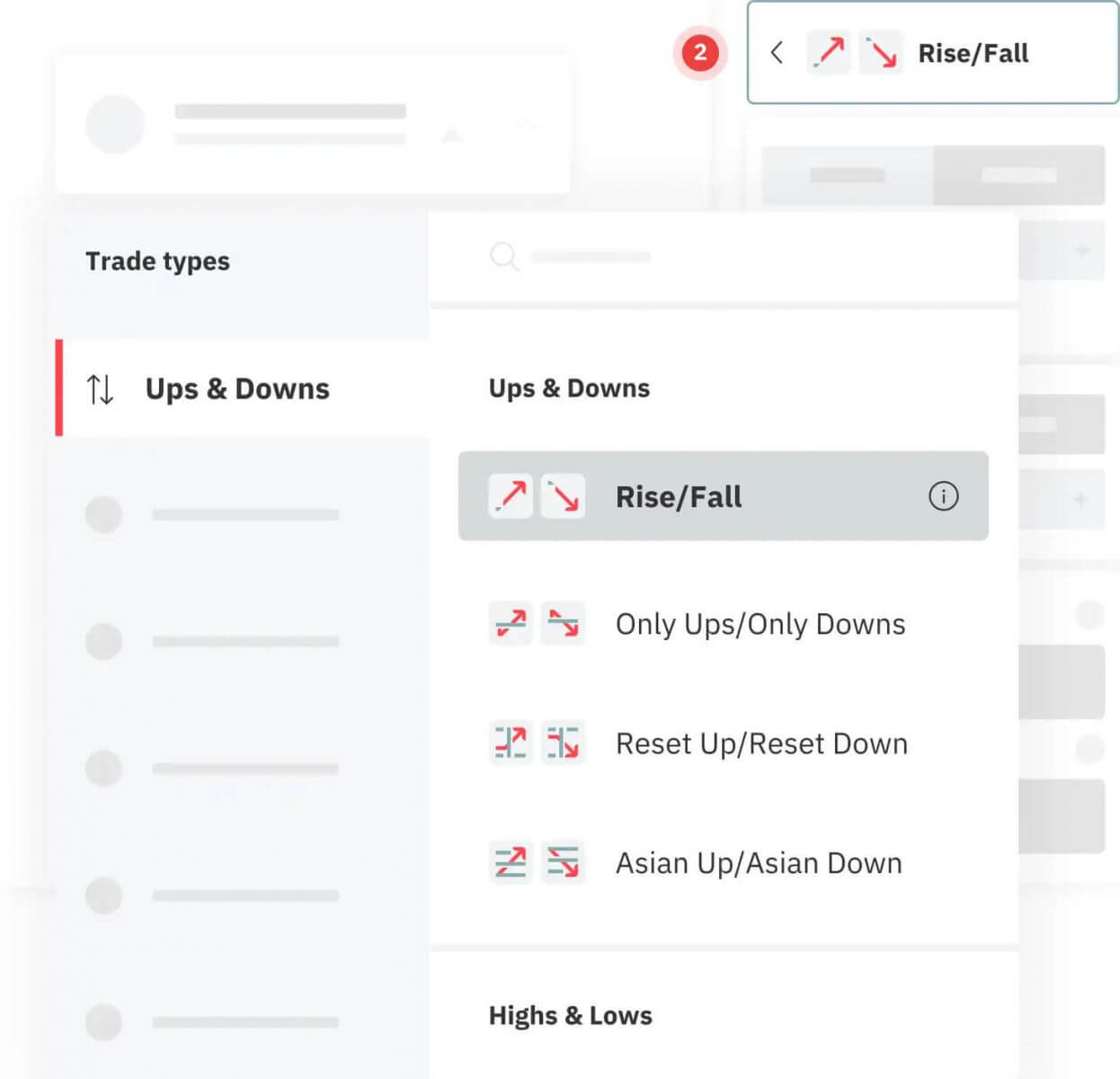

2. Tirdzniecības veids

- Izvēlieties vēlamo tirdzniecības veidu — augšup un lejup, augstāk un zemāk, cipari utt.

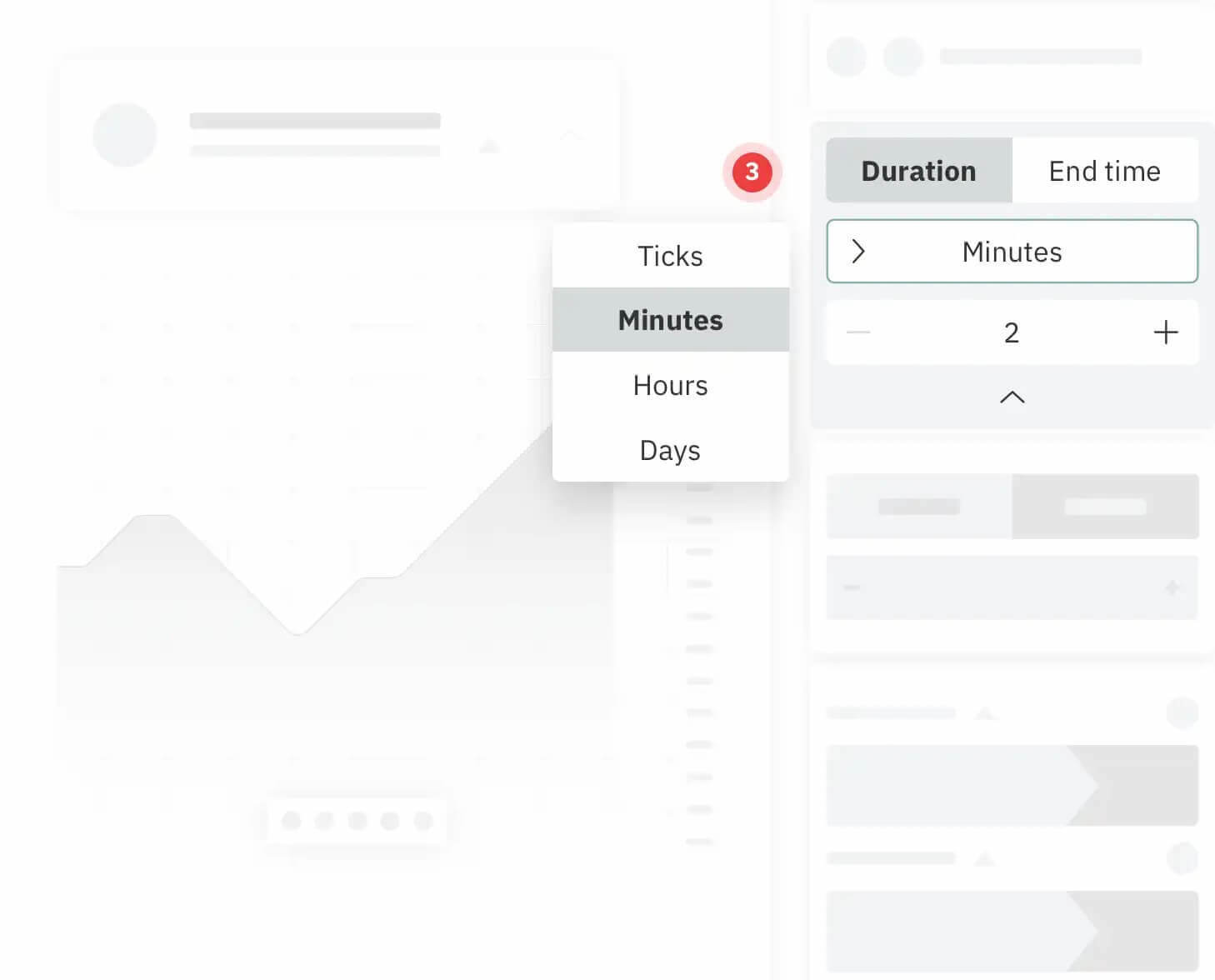

3. Ilgums

- Iestatiet sava darījuma ilgumu. Atkarībā no tā, vai jums ir īstermiņa vai ilgtermiņa skatījums uz tirgiem, varat iestatīt vēlamo ilgumu, sākot no 1 līdz 10 tikiem vai no 15 sekundēm līdz 365 dienām.

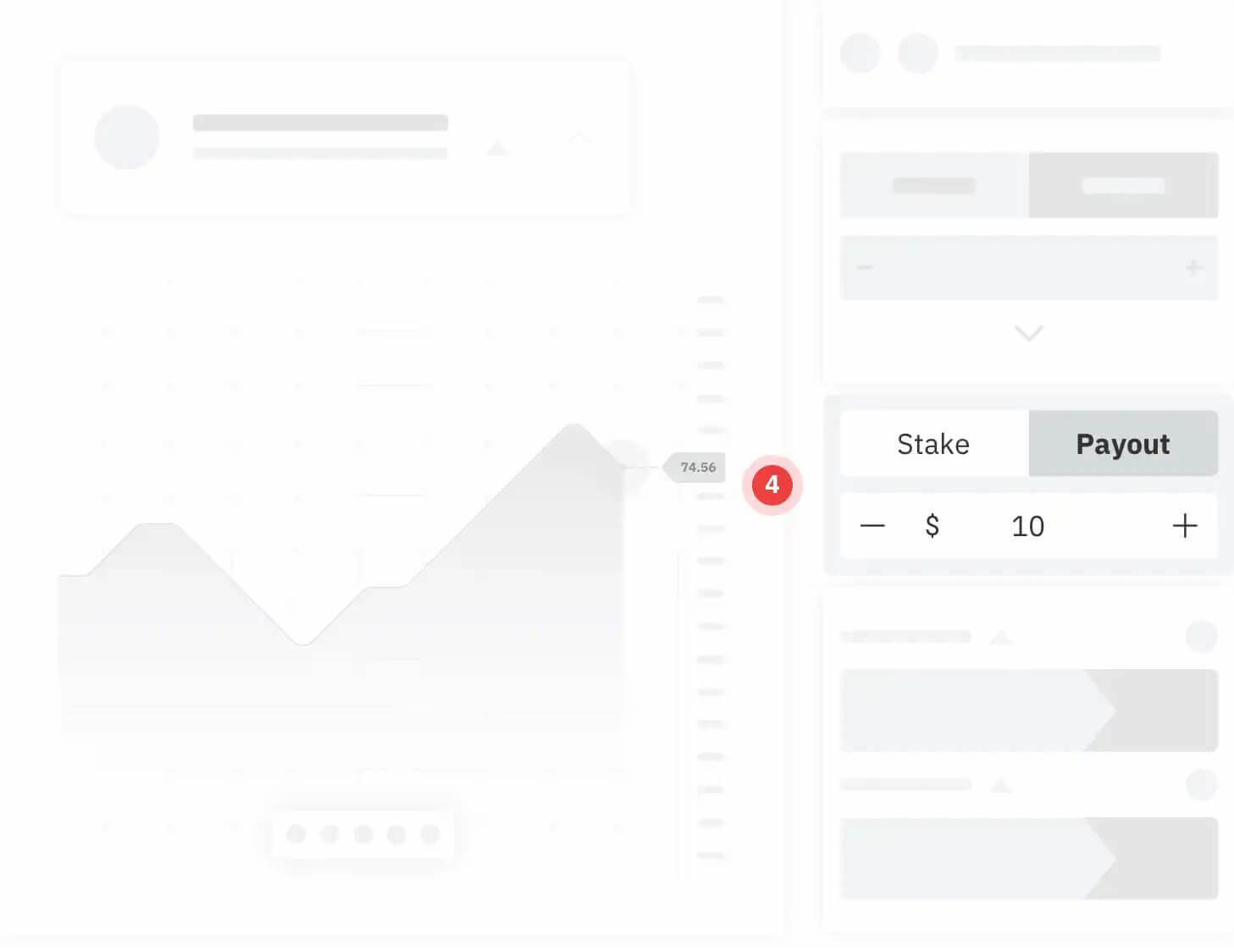

4. Likme

- Ievadiet savu likmes summu, lai nekavējoties saņemtu izmaksas piedāvājumu. Varat arī iestatīt vēlamo izmaksu, lai saņemtu cenas piedāvājumu atbilstošajai likmes summai.

Saņemt cenu piedāvājumu

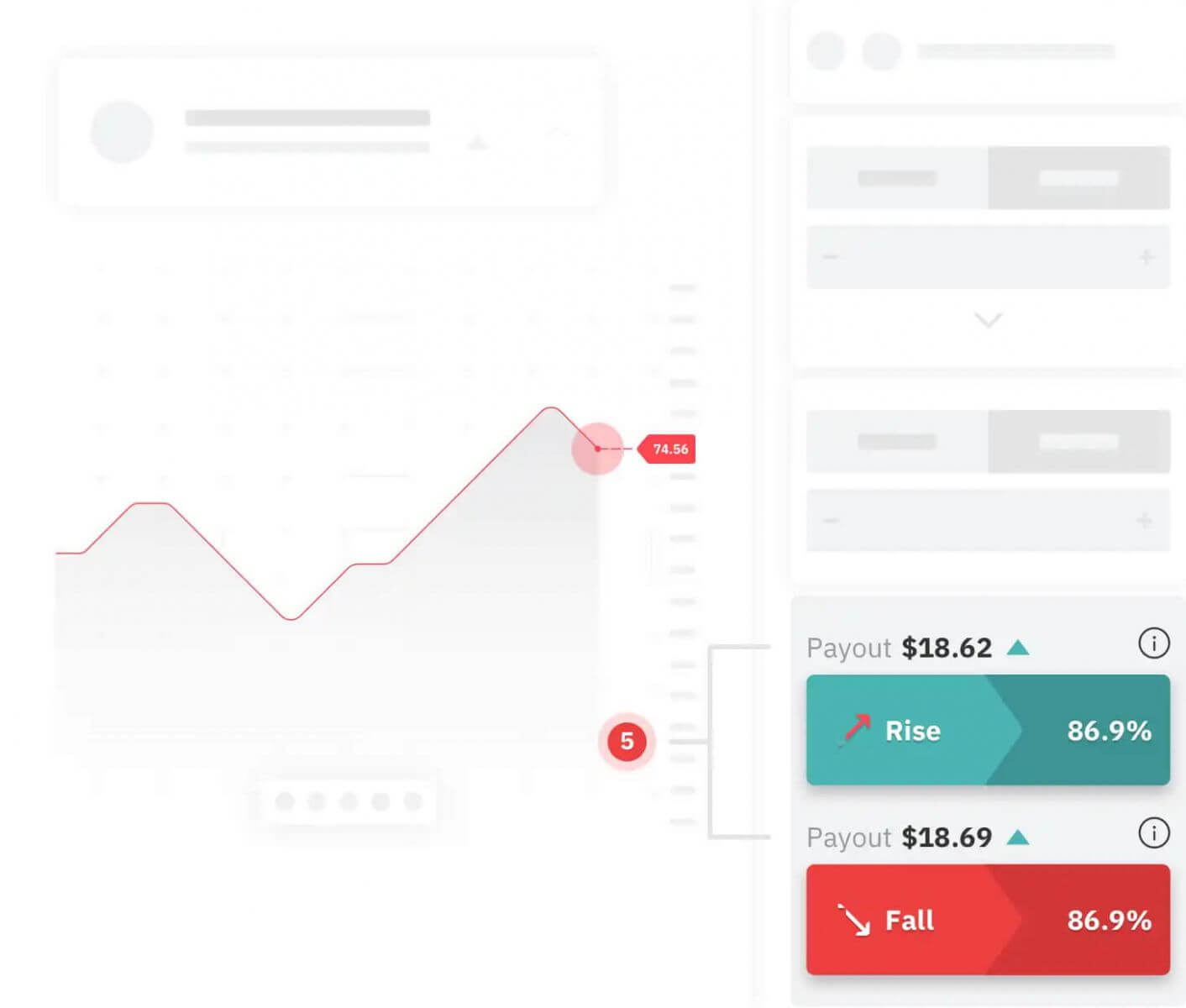

5. Saņemt cenu piedāvājumu

- Pamatojoties uz jūsu definēto pozīciju, jūs nekavējoties saņemsiet izmaksas piedāvājumu vai likmes piedāvājumu, kas nepieciešams pozīcijas atvēršanai.

Iegādājieties līgumu

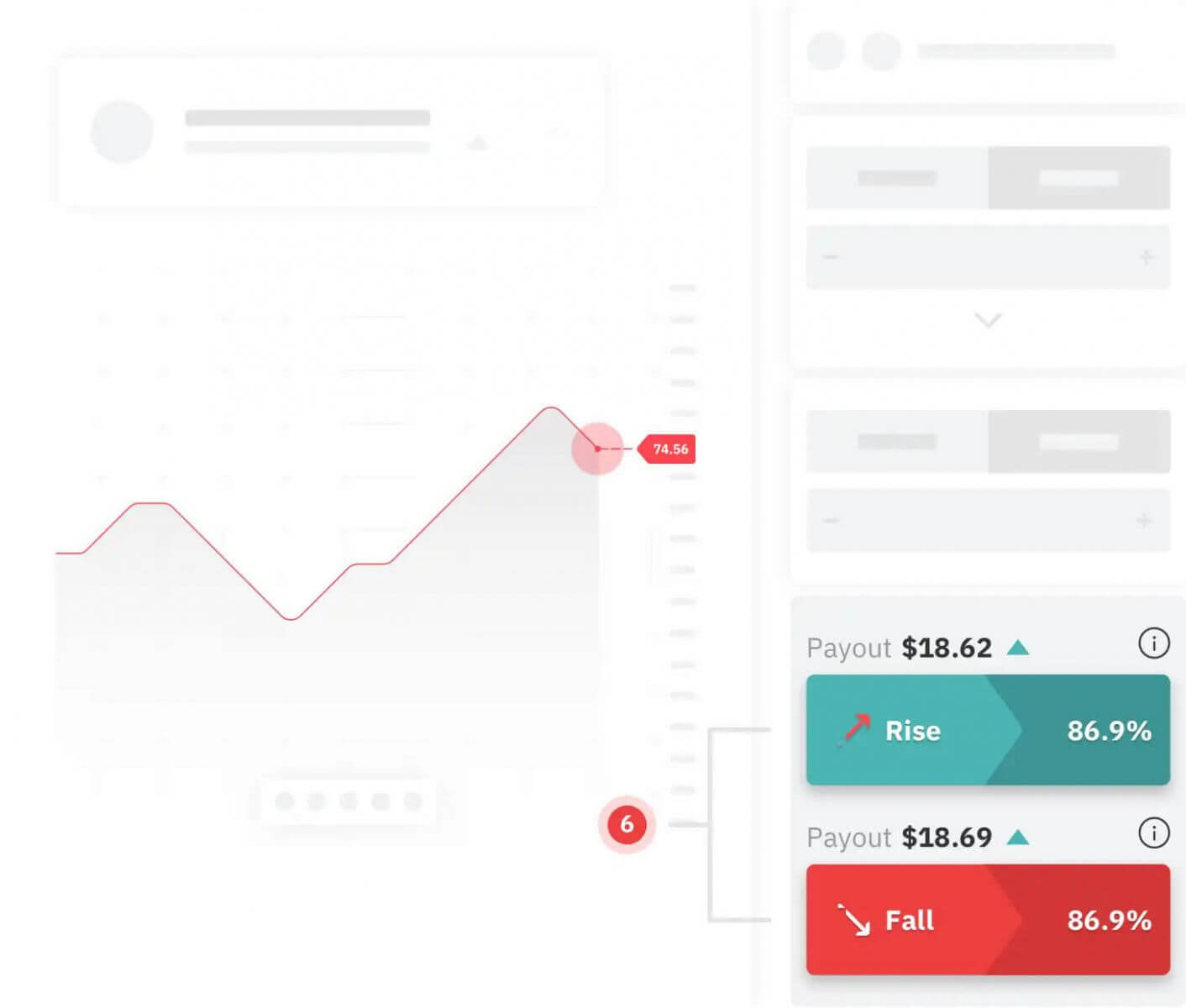

6. Iegādājieties līgumu

- Ja esat apmierināts ar saņemto cenu piedāvājumu, nekavējoties veiciet pasūtījumu. Pretējā gadījumā turpiniet pielāgot parametrus un iegādājieties līgumu, kad esat apmierināts ar cenu piedāvājumu.

Opcijas tirdzniecībai Deriv platformā

Augšup/Lejup

Kāpums/Kritums

Paredzēt, vai līguma perioda beigās izejas punkts būs stingri augstāks vai zemāks par ieejas punktu.

- Ja izvēlaties “Augstāks”, jūs laimējat, ja izejas vieta ir stingri augstāka par ieejas vietu.

- Ja izvēlaties “Zemāks”, jūs laimējat, ja izejas vieta ir stingri zemāka par ieejas vietu.

Augstāks/Zemāks

Paredziet, vai izejas vieta līguma perioda beigās būs augstāka vai zemāka par cenas mērķi (barjeru).

- Ja izvēlaties “Augstāks”, jūs laimējat, ja izejas punkts ir stingri augstāks par barjeru.

- Ja izvēlaties “Zemāks”, jūs laimējat, ja izejas vieta ir stingri zemāka par barjeru.

Ieeja/Izeja

Beidzas starp/Beidzas ārpusē

Paredzēt, vai izejas punkts līguma perioda beigās atradīsies divu cenu mērķu iekšpusē vai ārpusē.

- Ja izvēlaties "Beidzas starp", jūs laimējat, ja izejas vieta ir stingri augstāka par zemāko barjeru un zemāka par augstāko barjeru.

- Ja izvēlaties "Beidzas ārpusē", jūs laimējat, ja izejas vieta ir vai nu stingri augstāk par augsto barjeru, vai stingri zemāk par zemo barjeru.

Paliek starp/iziet ārpusē

Paredziet, vai tirgus jebkurā brīdī līguma darbības laikā paliks divu cenu mērķu robežās vai izies ārpus tiem.

- Ja izvēlaties “Paliek starp”, jūs laimējat, ja tirgus jebkurā laikā līguma darbības laikā paliek starp (nesaskaras) vai nu ar augsto, vai zemo robežu.

- Ja izvēlaties “Iet ārpusē”, jūs laimējat, ja tirgus jebkurā laikā līguma darbības laikā sasniedz vai nu augsto, vai zemo robežu.

Cipari

Sakrīt/Atšķiras (Matches/Differs)

Paredziet, kāds skaitlis būs līguma pēdējā tikša pēdējais cipars.

- Ja izvēlaties “Matches” (Atbilstības), jūs laimēsiet laimestu, ja pēdējā tikšķa pēdējais cipars sakritīs ar jūsu prognozi.

- Ja izvēlaties “Atšķiras”, jūs laimēsiet laimestu, ja pēdējā tikšķa pēdējais cipars nesakritīs ar jūsu prognozi.

Pāra/Nepāra skaitlis.

Paredzēt, vai līguma pēdējā tikša pēdējais cipars būs pāra skaitlis vai nepāra skaitlis.

- Ja izvēlaties “Pāris”, jūs laimēsiet, ja pēdējā tikšķa pēdējais cipars ir pāra skaitlis (piemēram, 2, 4, 6, 8 vai 0).

- Ja izvēlaties “Nepāra skaitlis”, jūs laimēsiet, ja pēdējā tikšķa pēdējais cipars ir nepāra skaitlis (piemēram, 1, 3, 5, 7 vai 9).

Virs/Zem (Over/Under)

Paredzēt, vai līguma pēdējā tikša pēdējais cipars būs lielāks vai mazāks par noteiktu skaitli.

- Ja izvēlaties “Virs”, jūs laimēsiet laimestu, ja pēdējā tikšķa pēdējais cipars ir lielāks par jūsu prognozi.

- Ja izvēlaties "Zem", jūs laimēsiet laimestu, ja pēdējā tikšķa pēdējais cipars ir mazāks par jūsu prognozi.

Atiestatīt zvanu/atiestatīt ievietošanu

Paredzēt, vai izejas punkts būs augstāks vai zemāks par ieejas punktu vai punktu atiestatīšanas laikā.

- Ja izvēlaties "Atiestatīt-Atsaukt", jūs laimējat, ja izejas vieta ir stingri augstāka par ieejas vietu vai vietu atiestatīšanas laikā.

- Ja izvēlaties “Atiestatīt-Put”, jūs laimējat, ja izejas vieta ir stingri zemāka par ieejas vietu vai vietu atiestatīšanas laikā.

Augstas/zemas atzīmes

Paredziet, kurš būs augstākais vai zemākais tikšs piecu tiku sērijā.

- Ja izvēlaties “Augsts tikšs”, jūs laimējat, ja izvēlētais tikšs ir augstākais no nākamajiem pieciem tikšiem.

- Ja izvēlaties “Zems atzīmes punkts”, jūs laimējat, ja izvēlētais atzīmes punkts ir zemākais no nākamajiem pieciem atzīmes punktiem.

Pieskāriens/Bez pieskāriena

Prognozēt, vai tirgus līguma darbības laikā jebkurā brīdī sasniegs vai nesaskarsies ar mērķi.

- Ja izvēlaties “Pieskārieni”, jūs laimējat, ja tirgus jebkurā laikā līguma darbības laikā pieskaras barjerai.

- Ja izvēlaties “Nepieskaras”, jūs laimējat, ja tirgus nekad nepieskaras barjerai līguma darbības laikā.

Aziāti

Prognozējiet, vai izejas punkts (pēdējais tikšs) būs augstāks vai zemāks par tikšu vidējo vērtību līguma perioda beigās.

- Ja izvēlaties "Āzijas pieaugums", jūs laimēsiet, ja pēdējais tikšķs būs augstāks par tikšķu vidējo vērtību.

- Ja izvēlaties "Āzijas kritums", jūs laimēsiet laimestu, ja pēdējais tikšķs būs zemāks par tikšķu vidējo vērtību.

Ja pēdējais tikšķs ir vienāds ar tikšķu vidējo vērtību, jūs neuzvarēsiet.

Tikai kāpumi/tikai kritumi

Paredzēt, vai secīgi tiki pēc ieejas punkta pieaugs vai kritīsies secīgi.

- Ja izvēlaties “Tikai augšupvērstie punkti”, jūs laimējat, ja pēc ieejas punkta secīgi pieaug vairāki punkti. Laimests netiek piešķirts, ja kāds no iepriekšējiem punktiem nokrīt vai ir vienāds ar jebkuru no tiem.

- Ja izvēlaties "Tikai kritumi", jūs laimējat, ja pēc ieejas punkta secīgi nokrīt vairāki sitieni. Laimests netiek izmaksāts, ja kāds no iepriekšējiem sitiem pieaug vai ir vienāds ar jebkuru no tiem.

Augstas cenas/zemas cenas, Āzijas cenas, Atiestatīt pirkšanas opciju/Atiestatīt pārdošanas opciju, Cipari un Tikai augšupejošas cenas/Tikai lejupejošas cenas ir pieejamas tikai sintētiskajiem indeksiem.

Atskati

Augsta-slēgšana

Iegādājoties “Augsta-slēgšanas” līgumu, jūsu uzvara vai zaudējums būs vienāds ar reizinātāju, kas reizināts ar starpību starp augstāko un zemāko cenu līguma darbības laikā.

Aizvēršana-zema cena

Iegādājoties “Aizvēršana-zema cena”, jūsu uzvara vai zaudējums būs vienāds ar reizinātāju, kas reizināts ar starpību starp slēgšanu un zemāko cenu līguma darbības laikā.

Augsta-zema cena

Iegādājoties “Augsta-zema” līgumu, jūsu uzvara vai zaudējums būs vienāds ar reizinātāju, kas reizināts ar starpību starp augstāko un zemāko cenu līguma darbības laikā.

Atskatīšanās opcijas ir pieejamas tikai sintētiskajiem indeksiem.

Bieži uzdotie jautājumi

Kas ir DTrader?

DTrader ir uzlabota tirdzniecības platforma, kas ļauj tirgoties ar vairāk nekā 50 aktīviem digitālo, reizinātāju un retrospektīvo opciju veidā.

Kas ir Deriv X?

Deriv X ir ērti lietojama tirdzniecības platforma, kurā varat tirgoties ar dažādu aktīvu CFD platformas izkārtojumā, ko varat pielāgot savām vēlmēm.

Kas ir DMT5?

DMT5 ir MT5 platforma Deriv platformā. Tā ir vairāku aktīvu tiešsaistes platforma, kas paredzēta, lai sniegtu gan jauniem, gan pieredzējušiem tirgotājiem piekļuvi plašam finanšu tirgu klāstam.

Kādas ir galvenās atšķirības starp DTrader, Deriv MT5 (DMT5) un Deriv X?

DTrader ļauj tirgoties ar vairāk nekā 50 aktīviem digitālo opciju, reizinātāju un retrospektīvo rādītāju veidā. Gan Deriv MT5 (DMT5), gan Deriv X ir vairāku aktīvu tirdzniecības platformas, kurās varat tirgoties ar valūtas maiņas darījumiem (forex) un CFD ar sviras efektu vairākās aktīvu klasēs. Galvenā atšķirība starp tām ir platformas izkārtojums — MT5 ir vienkāršs viss vienā skats, savukārt Deriv X varat pielāgot izkārtojumu atbilstoši savām vēlmēm.

Kādas ir atšķirības starp DMT5 sintētiskajiem indeksiem, finanšu un finanšu STP kontiem?

DMT5 Standard konts piedāvā gan jauniem, gan pieredzējušiem tirgotājiem augstu sviras efektu un mainīgus spredus maksimālai elastībai. DMT5 Advanced konts ir 100% A grāmatas konts, kurā jūsu darījumi tiek nodoti tieši tirgum, dodot jums tiešu piekļuvi Forex likviditātes nodrošinātājiem.

DMT5 sintētisko indeksu konts ļauj jums tirgoties ar starpības līgumiem (CFD) uz sintētiskiem indeksiem, kas atdarina reālās pasaules kustības. Tas ir pieejams tirdzniecībai visu diennakti, un tā taisnīgumu pārbauda neatkarīga trešā puse.